BHP Billiton and Rio Tinto, the world’s largest and second biggest mining companies respectively, have been steadily cutting their exposure to thermal coal over the past two years, but without making any big announcements about it.

Pushed by slack demand, prices at multiyear lows, and relentless opposition to new coal projects, the companies are seeking to reduce their investments in coal used for power stations.

But according to analysts interviewed by the Australian Financial Review, they want to do so without making too much noise about it, as they don’t want to jeopardize the sale of some of their coal mines by signalling they think poorly of the commodity.

"Rio and BHP are still out there flying the flag for coal, but I think they are repositioning behind the scenes," Pengana Global Resources Fund analyst Tim Schroeders told the paper.

In fact, the companies have managed to keep a neutral stance by singing coal’s praises when asked about it. A couple of weeks ago, Jean-Sebastien Jacques, Rio Tinto’s chief executive for copper and coal, told a Bloomberg conference in Sydney that coal demand was not going to disappear. But he added later the company had “better options” than to spend money on the commodity.

“There is a future for coal. Now the question is, should it be Rio or not Rio” that owns the mines, Jacques told the audience. “If you have a big checkbook, I’m more than happy to take your name.”

Coal assets from North America to Australia have been up for sale by the world’s biggest miners, which are seeking to protect profits from sharply lower commodity prices. Producers have also been a frequent a target for environmental campaigners, who have stepped up campaigns for a moratorium on coal mines and for investors to sell their shares in fossil fuel companies.

Last month, 52 leading scientists, economists and experts from around the world published an open letter calling for a moratorium on new mines ahead of the climate change talks in being held in Paris this week.

This is how they've done it

Last year Rio sold its Mozambique coal assets to India’s International Coal Venture Private Ltd (ICVL), marking the end of a dreadful venture for the miner. (Imagecourtesy of Rio Tinto)

So far, Rio Tinto seems to be leading the coal exiting game. In February, the company folded its coal operations into its copper division, a step that was widely seen as signalling a reduced focus on the fossil fuel.

Later in the year, it announced the sale of a 40% stake in its Australian Bengalla mine as part of a divestment aimed at ditching coal operations in New South Wales, which could be worth between $3bn and $4bn. When revealing the sale, Rio also said it had restructured one of its main Australian coal businesses —Coal & Allied—, where Mitsubishi Development of Japan previously held a 20% stake, and it is now solely owned by the Anglo-Australian miner.

Rio has also unloaded Mongolian coal miner South Gobi Resources and the unsuccessful Riversdale project in Mozambique.

BHP Billiton has done its part too. While it has kept some major assets such as Mt Arthur mine in the Hunter Valley, Cerrejón Coal in Colombia, and a group of metallurgical coal assets in Queensland, the firm sold its thermal coal business in South Africa after spinning-off assets into a separate company, South32.

The firm has also said it may reconsider its push into coal mining in Borneo, depending on the what comes out of the Indonesian government ongoing review of the sector’s regulations.

The coal business doesn’t look nearly as promising as it did two years ago, when miners were looking for mines to buy hoping to meet China’s demand, the world’s top coal consumer. But with economic growth weakening many power generators shifting to gas or renewable energy, global coal shipments are falling for the first time in 21 years, the U.S. Energy Information Administration said last month.

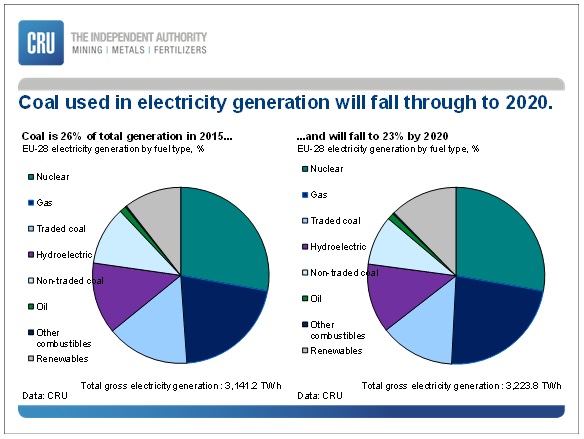

CRU Group is predicting a fall in coal-fired power generation in Europe through to 2020. (Chart courtesy CRU)

Meanwhile, The International Energy Agency (IEA) predicts global coal demand will increase just 0.4% a year to 2040, a marked slowdown from the 4.1% annual growth of the past decade and well behind the expansion of sectors such as renewables, which it forecasts will overtake coal as the largest source of power generation by the early 2030s.

Dynamic Machinery Technology Co., Ltd.

Add:Liaocheng Economic and Technological Development Zone in Shandong Province